A very commonly asked question: What is Venture Capital? A Venture Capitalist (VC) is used to refer to an investor who provides capital to firms that exhibit high growth potential in exchange for an equity stake.

Private equity in recent decades has gained much traction in the financial world and currently represents a major component of the alternative investment universe although its functioning is difficult to define and often misunderstood. What is venture capital is an important question that contains many nuances.

Popularity of Venture Capital Funding

The Ernst and Young Global Capital Confidence Barometer illustrate this point in a survey with the question: “What will be the primary source of finance you will be leveraging to fund your growth strategies in the next 12 months?”, a question to which 20% of private company owners primarily named private equity financing, thus making it the second most popular choice behind private debt financing.

This thus indicates that VC is a clearly prioritised and highly sought after form of financing in the world of capital raising these days. Given that the business landscape in recent years has been one of the low-interest rates and technology-driven business models, this will challenge the way private equity firms have traditionally operated.

What does Venture Capital and Private Equity entail?

Private equity encompasses an array of investment and financing activities; activities of which include the restructuring of capital, buyout financing as well as venture capital.

So what is venture capital? For most purposes, Venture Capital is considered a subset of private equity and in its detailed form and definition, refers to an equity or equity-linked investments made specifically for the launch, early growth or expansion of companies. This is why venture capital is almost inextricably linked with start-ups and entrepreneurship.

What do Venture Capital Firms Look For?

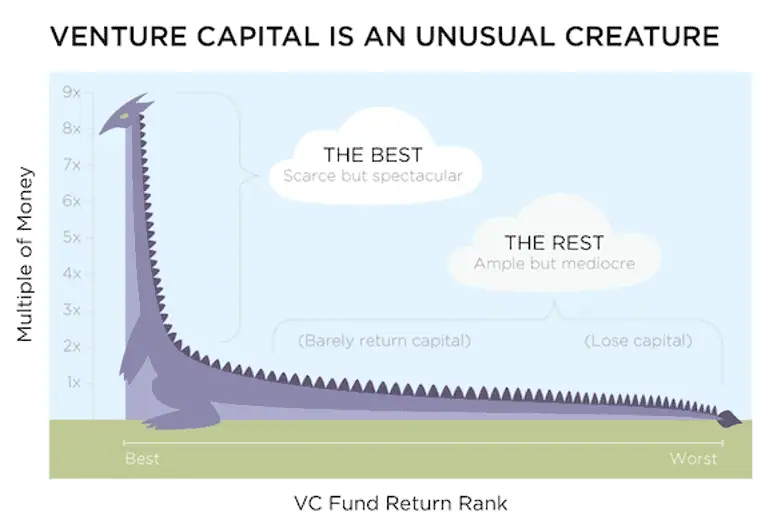

What is a venture capital and what do most venture capital firms look for? Venture Capital target firms that are at the stage where they are looking to commercialise their idea, however, because of this factor, Venture Capitals tend to experience high rates of failure due to the uncertainty that is involved with new and unproven companies.

However, venture capitalists are willing to take on the risk associated with investing in unproven and green companies because they will then be able to reap the rewards of a massive return on their investments if these companies turn out to be profitable and a success.

What is Venture Capital and their link with Startups?

Start-ups have a symbiotic relationship with venture capitalists because a primary challenge being faced by small companies or start-up ventures is the inability to access equities markets, meaning markets in which shares of companies are issued and traded either through exchanges or over the counter markets, also known as the stock market.

These markets serve as one of the more vital areas of a market economy as it is instrumental in giving companies the access to capital to grow their business and investors a piece of ownership within a company with the potential realise gains on their investment based on the company’s future performance.

How are Venture Capital firms formed?

Venture capitalists are typically formed as limited partnerships where the partners then invest in the VC fund. A committee is typically tasked with managing the fund and making investment decisions and once-promising emerging growth companies to have been identified, the pooled investor capital that has been collected is then deployed to fund these firms in exchange for a sizeable stake of equity.

Myths and Misconceptions around Venture Capital

What is venture capital and some of the misconceptions surrounding it? A common misconception surrounding the concept of venture capital is that VCs generally do not fund start-ups from the onset. Rather, most venture capitalists seek to target firms which are at the stage where the firm is looking toward commercialising their ideas.

The venture capital fund will then buy a stake in these firms, nurture their growth and development and then look to cash out with a substantial return on investment, a performance measure used to evaluate the efficiency of an investment which is typically calculated by dividing the benefit (meaning, return) of an investment by the costs of an investment.

It is worth noting that contrary to the popular and public perception of venture capital as a major boon for financing new ideas, venture capital plays only a minor role in funding basic innovation. Venture capitalists invested more than 10 billion USD in 1997, but only 6% or so, around 600 million USD went to startups.

Research done by the Harvard Business Review reveals that less than 1 billion USD of the total venture capital pool goes toward Research and Development and the majority of the capital went onto fund projects that had originally developed through the far greater expenditures of governments (estimated to be around 63 billion USD) as well as corporations (estimated to be around 133 billion USD).

Historical Context of Venture Capital

As a subset of private equity, the inception of private equity can be traced back to the 19th century, where century capital only developed as an industry post World War Two. Pre-WW2, much of innovative technologies or methods of funding were almost exclusively confined to being established within only big companies or wealthy families who had the means independently.

Particularly such circumstances were heightened by the social, economic and political environment of the world. The 1929 stock market crash followed by the Great Depression and World War II all culminated and served to create an environment that was decidedly not entrepreneur-friendly. Following WWII, the generation coming out of war and strife was full of innovation and new ideas as potential entrepreneurs began to arise within global financial market leaders such as the US and Europe whose economies were in a prolonged post-war boom phase.

What is Venture Capital: Roots of VC

The first formal trace of venture capital can be traced back to 1964 where Georges Doriot was responsible for establishing the venture capital cum private equity firm American Research and Development Corporation (ARDC) which raised 3.5 million USD, of which 1.8 million USD came from a variety of institutional investors and higher education institutions such as MIT, Penn as well as the Rice Institute.

How Legislature Impacts Venture Capital

These ventures into new methods of raising capital and finance were encouraged and further systematically structured through the passing of legislature to make the economic environment more conducive and friendly towards small and medium-sized enterprises such as the Small Business Investment Act.

This was particularly significant given that it is the act that is served to give tax breaks to print investment companies and as a result, professionals managed venture capital firms too emerged through licensing private, small business investment companies to finance and manage their start-ups.

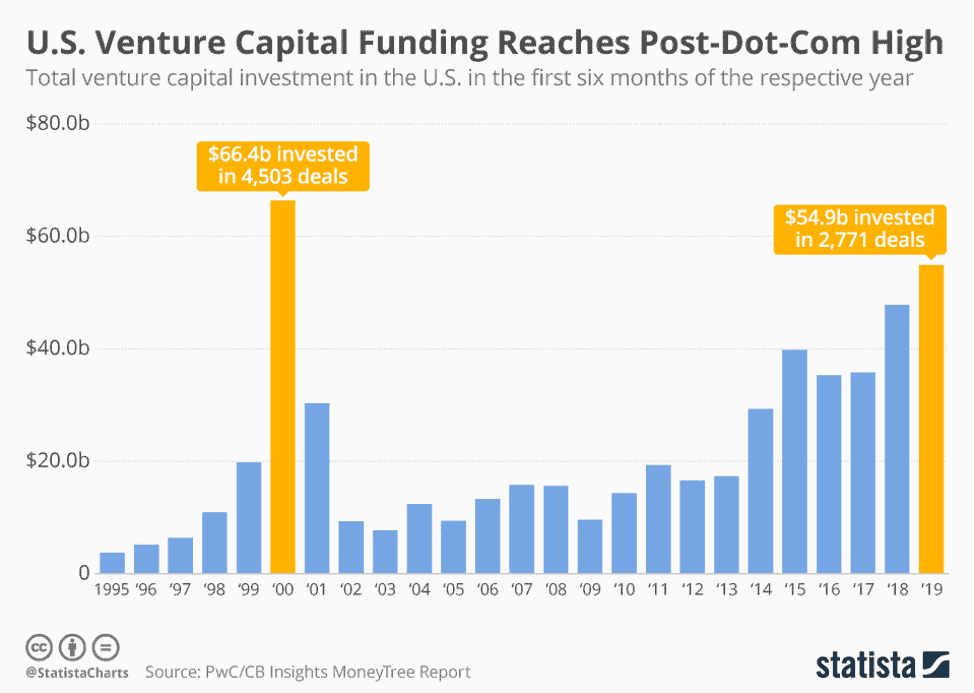

Thus, driven by technological developments in ICT, Internet and biotechnology, the venture capital industry experienced extraordinary growth over the decades and is now also broadly accepted as an established asset class within many institutional portfolios worldwide.

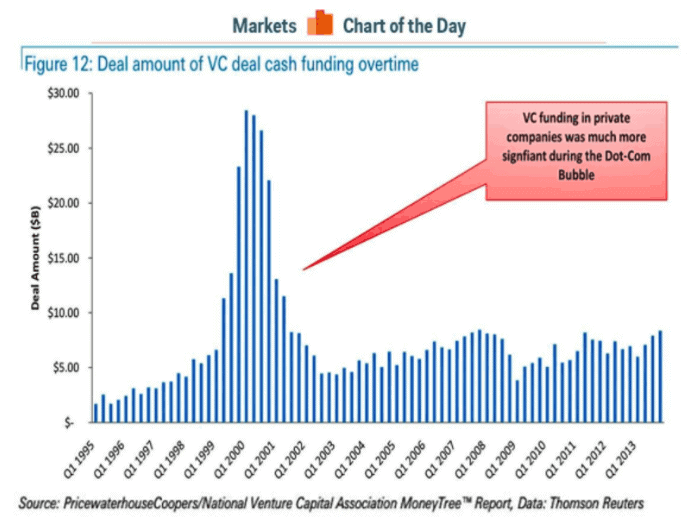

Through examining historical trends and data, it becomes clear the significant role that venture capital now plays in emerging new world order and the global financial market. What is venture capital and its relation to any funds committed specifically for them? Funds committed to venture capital had increased significantly from 2.3 billion USD in 1990 to a record of 104.8 billion USD in 2000 within the United States.

What is Venture Capital and the Impact of VC on the Technology Sector

By the end of the 1980s, venture capital was known to have funded major technology leaders such as Compaq, Intel, McAfee, Hotmail and Skype which then encouraged the growth of and ushered in a massive time of growth for the internet.

Despite as previously mentioned, these ventures having grown from the funding of far greater expenditures from the government and major corporations and so on, this still highly benefited venture capital firms as they provided frequent opportunities for new companies to emerge and go public as toward existing firms.

It also allowed and encouraged financing into the endless streams and groups of internets start-ups that would go on to change the landscape of technology forever such as Google, Facebook, Twitter and Pixa

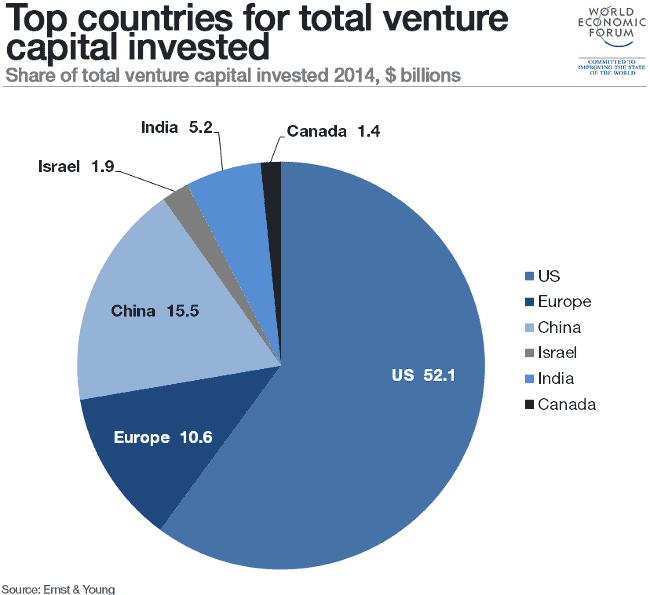

Venture Capital in Different Geographical Regions

What is venture capital and its correlation with geographical locations? Similar trends have also been observed within Europe, Asia and Australia, where venture capital markets have grown significantly over the last decades. China for instance, at the moment, is leading the market as one of the fastest-growing venture capital markets in the world.

In addition, while the venture capital market has long been a local industry with local entrepreneurs primarily operating and gaining funding through domestic means, the last decade within the 2000s and 2010s has witnessed a significant and remarkable increase and growth in the international flows venture capital worldwide.

As local markets become increasingly competitive, venture capitals have seen the need and pressure to widen their geographical horizons whilst broadening their geographic investment criteria to include international and foreign countries so as to increase their portfolio diversification and search for higher returns.

How has Venture Capital Influenced Local Competition?

What is venture capital and how has it affected or influenced the local economy for good or bad? Individual experiences of past macroeconomic outcomes have been shown to exert a long-lasting influence on beliefs about future realisations, which explains the increasing competitively of local venture capital as well as domestic stock market investment. This can be seen within Europe, where the share of inflows of venture capital from non-domestic sources was just over 50% of the market between 2005 and 2009 and the share of total outflows accounted for by cross border investments equalled close to 35% of the market over the same time period.

Also, by 2013 VC-backed US public businesses capitalised 115 billion USD in research and developments vs a total of zero in the year of 1979, these VC backed businesses now account for a 42% of the research and development spending by US public companies. These show that it not only produces values for those companies on which this research and development budget is expended upon, the positive spillovers arising from the innovation and creativity of research also help and assist in the rest of the worlds technological and efficiency innovation. So what is venture capital? A way to help technology grow.

Venture Capital in ASEAN

What are venture capital and its presence in the ASEAN region? For more information, click the following for more information on the venture capital within the ASEAN region specifically Singapore, Thailand, Vietnam, Indonesia and the Philippines.

Why does Venture Capital Exist and What Gap in the Market does it Service?

Beyond the need for financing, it has been indicated that the financing of entrepreneurial companies is addressed by primarily traditional sources of financing such as retained profits and owners funds and bank finance.

However, venture capital provides a more specialised set of investors that is unique.

Venture Capital firms as: Financial Mediators

What is venture capital and its role as finance mediators? In essence, venture capital firms exist as separate financial intermediaries, connecting willing investors with promising companies.

The main reason why venture capital firms thrive and exist is due to their superior abilities to reduce the cost of informational asymmetry related to investing in entrepreneurial companies and their ability to display investment strategies that allow them to cope with high uncertainty.

Asymmetric Information and How Venture Capital Combats this Issue

With asymmetric information, this persists as a problem within financial markets such as borrowing and lending because the borrower has much better information about his financial state than the lender. The lender has difficulty in knowing whether or not the borrower will default and to some extent, the lender will try to overcome this by looking at past credit history and the evidence of a reliable salary.

Asymmetric information is inherent in most if not all markets and arises when one party to an economic transaction has more or better information than another and then uses that to their advantage which in turn causes market failures including examples such as adverse selection.

Alternate Solutions to Asymmetric Information

Solutions to this issue include the introduction of regulations, offering warranties or guarantees etc. Free markets only work according to economic models that assume perfect information, the information is given and that is knowable in a way where all parties know all that is available but in reality, this is hardly ever the case.

Advantage of using Information Asymmetries Venture Capital Firms

Hence, venture capital investors have a comparative advantage over traditional financing sources such as banks and public equity investors in working in environments that are characterised by high information asymmetry and high uncertainty.

Within the entrepreneurship world, uncertainty is characteristic and endemic to the field. Spurred by economic liberalisation and the declining cost of communication, entrepreneurs need to turn their financial, technological and human assets into organisational resources that are capable of desired results.

High technology start-ups, in particular, the earliest types of organisations that the venture capital market found success in entering industries with very short technology and product life cycles where constant innovation is a must. Thus, when uncertainty hits, such entrepreneurs are already involved in a rather profound struggle, both to establish their companies and to survive.

Types of Informational Asymmetries

Two types of informational asymmetry typically arise within an entrepreneur and investor relationship, that of hidden information vs hidden action.

Hidden Information

Hidden information refers to the fact that parties hold different information as previously mentioned.

Outside financiers are also confronted with problems origination from hidden information or hidden action when they are investing in young, entrepreneurial companies.

Within the context of venture capital, adverse selection pertains to the risk that outside investors select low-quality projects, which have been presented to them and falsely advertised as high-quality projects.

This occurs due to the fact that entrepreneurs generally have an incentive to misrepresent any information in their possession especially during a task as personally involving as the search for financing. Clearly, as they are themselves involved in the operations of their business and know it intimately, hidden information occurs naturally.

How to Reduce the Risk of Hidden Information

To decrease the risk of adverse selection, venture capital investors engage in extensive information collection in a pre-investment due diligence process.

However, as is frequently emphasised there exists no systematic method of excluding all bias and projections within such delicate proceedings and the processes and instruments to reduce information asymmetries used by more traditional investors such as banks are insufficient to overcome hidden information problems within the context of investing in young companies and start-ups.

How other institutions reduce the risk of information asymmetry

Banks, for instance, employ extensive due diligence processes however much of this information is skewed and has a high focus on historical financial information.

However, many young companies and start-up have insufficient information let alone positive financial information. Without these number, traditional financing institutions can often be at a loss for how to proceed with the screening, valuation and evaluation of the company and start-up.

This remains the biggest obstacle for finance raising for young companies and start-up, the exclusion from traditional business social networks as well as capital and finance raising institutions due to these myriads of factors.

Furthermore, banks typically used collateral to deal with information problems however young companies with high potential often lack assets that may serve as collateral as the majority of their investments have a heavy research and development focus and therefore are intangible in nature.

The Role of Due Diligence

What is venture capital its role in due diligence? In contrast, much venture capital investors perform extensive due diligence prior to investing in order to reduce the nature of hidden information problems; focusing on creating more holistic and big picture reports, taking into account the value of the entrepreneurial team, the technology as well as product market characteristics.

Therefore, the characteristics that define companies that are raising venture capital are high growth, but high risk accompanied high prospects of profitability but that hold little collateral.

Hidden Action

Other than adverse selection problems, outside investors are also confronted with hidden action problems, since they are unable to perfectly observe the effort and actions of entrepreneurs.

This could lead to a mismatch of exceptions including the fact that perhaps because of lack of communication, the goals of entrepreneurs and investors may not be perfectly aligned.

After the investment, for example, entrepreneurs may shirk effort or invest in pet projects that are aimed at achieving private, non-monetary benefits but that are at the expense of eternal investors.

Why VC's work Better than Banks as Financiers

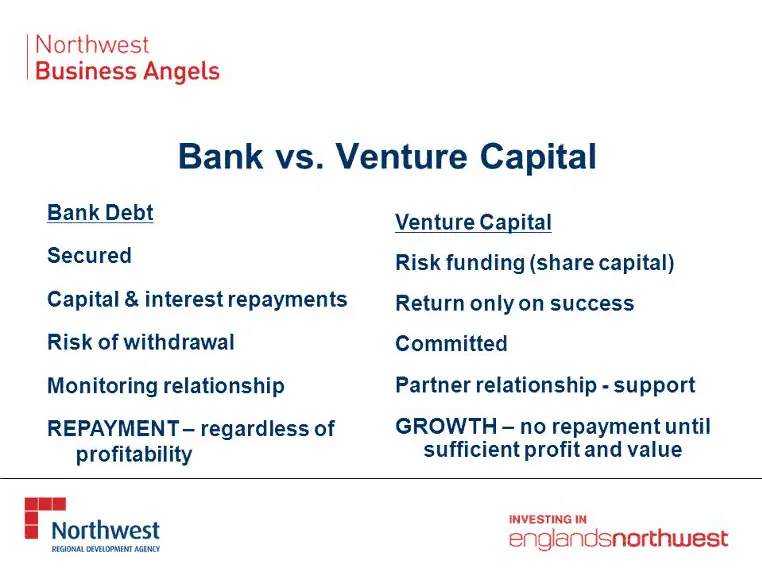

What is venture capital's reason for being better than banks as financiers? It is acknowledged that venture capital investors have a comparative advantage over banks in order to reduce moral hazard problems because of the method of financing that banks provide.

Banks provide debt finance that involves a fixed claim, which is restricted to interest and principle payments which then gives banks limited incentives to monitor their creditors.

Venture capital investors however typically provide equity and equity-linked securities that entail a claim on the company’s residual wealth creation due to the promise of the return on their investment.

This creates a high incentive for VC firms to more tightly monitor their investment portfolio as well as reduce the risk of hidden action given that whatever actions the firm carries out will have an impact on the returns potential which is in turn impacted by the company’s level of value creation.

Which Firms are more suited to VC

Taking this into consideration, it could be said that raising VC finance rather than bank debt is more highly suited and optimal for companies that face higher risk and positively skewed cash flows, with a low probability of success and low liquidation value.

In addition, venture capital investors write complex contracts that service to align the goals of both entrepreneurs and investors, which then reduces agency risks.

Concluding Thoughts

Overall then it can be seen that venture capital investors have a comparative advantage as compared to other traditional investors such as banks to reduce informational asymmetries and operating in environments that are characterised by high uncertainty.

It has also been seen that venture capital as an industry does positively boost the economy, assist in job creation as well as introduce a new median to the market that could seize the market share for the next generation.

Venture Capital investors fill an important niche in the financing of young, entrepreneurial companies and their comparative advantages as compared to other investors, such as banks and relates to their relative efficiency in selecting and monitoring investments characterised by high informational asymmetries and high uncertainty.

References

What is venture capital? https://www.investopedia.com/terms/v/venturecapital.asp

https://www.ey.com/en_gl/growth/how-can-private-equity-create-new-value

https://www.cbinsights.com/research/report/what-is-venture-capital/